Moses Byamukama pours maize flour into doser. Source: SPRING/Uganda

Under Uganda’s Food and Drug Act, producers of maize flour are required to fortify their products with a regulated blend of vitamins and minerals aimed at reducing national micronutrient deficiency. Only companies equipped to produce at a large scale are required to fortify, although maize millers of all sizes are encouraged to fortify voluntarily. From July 2016 to July 2017, Strengthening Partnerships, Results, and Innovations in Nutrition Globally (SPRING), USAID’s flagship multi-sectoral nutrition project, conducted interviews with 33 of the largest maize-milling companies in Uganda to determine the extent to which large-scale mills were fortifying and understand barriers and enablers to fortification. We collected information on the quantity of fortified flour produced each year, the market environment for fortified flour, fortificants and technologies used, and the incremental cost for fortification for medium- and large-scale millers.

Despite fortification being a requirement for large-scale mills, of the 28 large-scale mills surveyed, only 5 fortified their flour as of November 2017. The 5 companies fortifying in 2016 produced about 16,600 metric tons (MT) of fortified maize flour, with humanitarian agencies purchasing 89 percent of the final product, followed by local markets (9 percent) and schools (2 percent). Millers reported that humanitarian agencies purchase most of the fortified flour and that some is exported to countries such as Rwanda and Congo. Millers who produced flour for export followed a different standard for vitamins and minerals to be added in maize flour than millers who produced flour for local consumption. These millers said they added one-half the amount of premix per kilogram for the humanitarian standard compared to the Uganda/East Africa standard.

Of the 12 companies with fortification equipment in 2016, 8 had installed volumetric feeders with a continuous mode of adding premixes, 2 companies had installed loss-in-weight feeders, and 2 companies had installed batch mixers, which were obtained as a donation from development partners. The study identified that a number of factors are considered before selection of a particular type of fortification technology, including cost, accuracy, and simplicity of use.

Maize millers can choose between six suppliers for the regulated blend of vitamins and minerals, also known as premix. Only one of these suppliers is local; however, the Ministry of Health and the Ministry of Finance have worked together to eliminate import duties and reduce withholding taxes on imported premix.

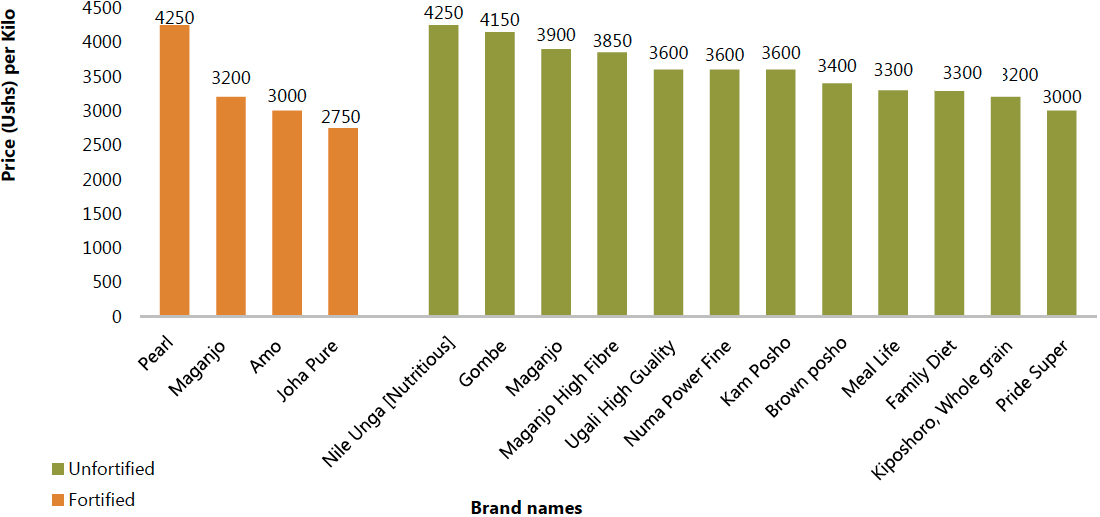

We found no relation between fortification and increased prices at the market. The cost of maize grains is the main cost driver across all producers of maize flour. For millers planning to fortify, the capital investment represented the greatest expense. But when considering recurring fortification costs, premix accounted for about 95 percent of the expense from fortifying. Over one year, a miller fortifying its flour will incur additional costs over a miller who does not fortify, but these costs are not high. The incremental cost of fortifying is marginally lower for millers operating on a higher scale (29.6 Uganda shillings [UGX] per kg) than for those operating on a slightly lower scale (UGX 30.6 per kg). From this study, we can conclude that maize flour fortification is still a challenge in Uganda even with the adoption of the mandatory fortification regulation.

Figure 1: The Food and Drugs Regulations, 2011

Background

Food fortification in Uganda has been a priority since the early 1990s. In 1997, the Ministry of Health (MOH) issued The Food and Drugs (Control of Quality) (Iodated Salt)) Regulations, 1997, mandating universal salt fortification in Uganda. The fortification program was expanded to additional food vehicles with the Food and Drugs (Food Fortification) Regulations, 2005, which called for industries producing wheat flour, maize flour, and edible oil and fat to voluntarily fortify their products. To promote increased production of fortified foods the MOH issued The Food and Drugs (Food Fortification) (Amendment) Regulations, 2011 (see Figure 1), which made fortification mandatory for multiple food vehicles, including maize flour (MOH 2011). The regulation requires all mills with an installation production capacity of 20 metric tons (MT) per day or more to fortify their products with a specified premix formulation (MOH 2017).

It is estimated that about 92 percent of Ugandan households consume maize flour, with a per capita consumption of about 22 kg of maize per year (GAIN 2015). About 42 percent of households access maize flour that is fortifiable, which is defined as any food not made at home and assumed to be industrially processed. However, the recent Fortification Assessment Coverage Tool (FACT) study reported that only 6.5 percent of households consume fortified maize flour (GAIN 2015). The country has made significant progress in implementing mandatory fortification regulations for wheat flour, edible oils, and salt, but maize flour fortification remains a challenge for two reasons: (1) most millers with an installed capacity of more than 20MT per day do not fortify and (2) the milling sector is dominated by small- and medium-scale (hammer) millers. In 2016, SPRING’s mapping of the maize-milling market found that only 0.5 percent of the 780 milling units (4 maize millers out of 780) fortify and that 4 percent of millers (32 maize millers out 780) had installed capacity of 20 MT per day or more (SPRING 2017). This report is the first attempt to summarize the reasons why millers required by law to fortify do not fortify.

This paper aims to summarize maize flour fortification practices among millers who are required to fortify as of 2017—that is, those with a production capacity of 20 MT or more—also describing their primary customers, standards used, technology used, premix suppliers, and quality assurance. Findings will be used to guide future efforts in programming and scale-up of maize flour fortification in Uganda.

Methodology

Survey design and methods

We interviewed the 32 maize millers with the largest capacity recorded in our mapping exercise (conducted in 2016) and one additional maize miller who later began fortification, for a total of 33 interviewees. The survey captured 28 large-scale maize millers with a daily production capacity of 20 MT or more, and five medium-scale maize millers with a production capacity of 10 MT or more per day. SPRING staff visited all the identified facilities and conducted in-depth key informant interviews with management personnel using semi-structured questionnaires (Annex 1).

To collect information on available food fortification technologies, we reviewed the Africa Maize Fortification Strategy (Enzama, Afidra, and Johnson 2017) and the Uganda National Industrial Food Fortification Strategy (MOH 2017), as well as published literature on fortification technology, and directly contacted suppliers and the Ministry of Trade, Industry and Cooperatives (MTIC) to determine prices and models available.

Survey respondents

Respondents included personnel from the 33 maize-milling companies that are knowledgeable in maize-flour processing, standards, marketing, and fortification. Depending on availability, we interviewed general managers, managing directors, production managers, quality control/quality assurance (QA/QC) officers, marketing managers, and plant managers.

Ethical considerations

All participants consented to participating in the study and all interviews respected participants’ privacy; all information and data obtained were kept confidential. For any data a company did not want shared (as specified by the company representative), the researchers used anonymous identifiers both in the analysis and reporting.

Data management and analysis

We collected qualitative data from the in-depth interviews held between July 2016 and July 2017, including questions on the perceptions of fortification, the market, the challenges faced, and support needed. We examined millers’ records for quantitative data, including the quantities of fortified flour produced, who it was sold to, and the pricing of flour, premixes, and equipment, and taxes paid. We visited local stores for market prices of all packaged maize flour.

To determine the incremental cost of fortification, we compared two large-scale maize mills located in different parts of the country that operated at different levels of production: one operating at 20 MT/day and the other at 60 MT/day. We evaluated the following factors: mill’s installed capacity, actual mill operating level (expressed as a percentage of the manufacturer’s rating), milling days per year, and total output per year calculated in metric tons. We divided costs due to fortification into two categories: (1) capital costs, which included machinery used in fortification, and (2) recurrent costs incurred annually as a result of fortification. Complete formulas and assumptions for the costing exercise are included in Annex 2.

Results

Figure 2: Surveyed millers by installed capacity and fortification equipment status

Overview of the largest maize millers in Uganda

Of the 33 millers visited, we identified 28 maize flour millers as having an installed capacity of 20 MT per day or more. By November 2017, only five of those mandated to fortify were currently fortifying, though 12 had installed fortifying equipment (see Figure 2). One finding of the mapping exercise was that some companies had installed fortification equipment that, for a number of reasons, was not being used.

Annex 3 shows the 28 milling companies with installed capacity to produce 20 MT/day or more, as of November 2017. A number of companies assumed they do not qualify for the mandatory legislation because they produce, on average, less than 20 MT per day. Installed capacity refers to the technology’s maximum capacity for maize flour. Actual production capacity may be lower, due to the miller’s current resources.

Total fortified maize flour milled in 2016

The five companies fortifying in 2016 produced about 16,600 MT of fortified maize flour (see Figure 3). Production varied among the companies, with one company producing nearly three-fourths of maize flour in 2016. Production also varied depending on season, availability and price of maize, demand by key markets, and availability and price of other food staples in the local market. Some companies only produce fortified maize flour on special orders from clients, including humanitarian agencies, while others companies fortify all their maize flour.

Figure 3: Absolute amount of fortified maize flour produced in 2016

Fortified maize flour customers in 2016

Millers reported that 89.4 percent of their fortified flour was purchased by humanitarian agencies, with the biggest buyer being the World Food Programme (WFP). Only 10.3 percent was consumed by the local market: 9 percent by supermarkets/shops and 0.3 percent by institutions such as schools (Figure 4).

Figure 4: Proportions of fortified maize flour procured by different institution

Millers reported that schools generally do not purchase fortified flour from them for several reasons: limited awareness of the benefits and the availability of fortified maize flour, perceived high additional costs associated with fortification, and the fears about the general safety of fortified maize flour. Millers said that schools need additional education on how to store fortified maize flour, as one informant reported:

We sold about 20 MT to a school. We informed them the flour was fortified and the shelf life was six months. What happened is that they did not use all the flour before the term ended. When the [new] term started, they said it had spoilt; it developed an after-taste after four months, and they wanted us to replace it. Actually, it is because they stored it in poor conditions; so we could not [replace it]. They need to have good storage. The school never came back to buy more. We need to accompany the selling with education on use and storage, and maybe support them.

The companies that produce the largest volume of fortified maize flour produce primarily for humanitarian agencies, particularly WFP (Figure 5). The company producing the largest volume of fortified maize flour (12,000 MT per year) exclusively produces for humanitarian agencies. Millers reported that humanitarian agencies purchase this flour for export to Rwanda or Congo.

Figure 5: Proportion of fortified maize flour sold to humanitarian agencies and to the local market

Fortification standards used in Uganda

A standard provides a list of vitamins and minerals to be added in maize flour as well as specifies the minimum and maximum level of each vitamin and mineral. Uganda has adopted the harmonized Uganda standard/East Africa fortification standards on maize flour fortification (US: EAS 768), shown in Table 1. All fortifying companies, whether acting voluntarily or under the mandatory regulation, must follow this premix formulation.

Table 1: Premix Formulation According to US: EAS Standard

| Nutrient | Fortificant Compound | Quantity (g/kg) |

|---|---|---|

| Vitamin A | Retinyl palmitate, spray-dried or equivalent, 0.075% retinol, minimum | 2 |

| Vitamin B1 | Thiamin mononitrate, 81%, minimum | 9 |

| Vitamin B2 (riboflavin) | Riboflavin, 100%, minimum | 6 |

| Vitamin B3 (niacin) | Niacinamide, 99%, minimum | 50 |

| Vitamin B6 (pyridoxine) | Pyridoxine, 82%, minimum | 10 |

| Vitamin B9 (folate) | Folic acid, 100%, minimum | 2 |

| Vitamin B12 | Vitamin B12, water-soluble form, 0.1%) | 0.03 |

| Zinc | Zinc oxide, 80%, minimum | 80 |

| Iron | NaFeEDTA, 13% iron, minimum | 37 |

| Filling material (25 %) |

We found that some companies—including those that sell fortified maize flour to the local market—are using another fortification standard, provided by WFP. The two standards follow the same premix formulation, but have different quantities of premix per metric ton. While the US: EAS standard requires 500 g of the specified premix to be added to each metric ton of maize flour, the WFP standard requires only 250 g per metric ton. The WFP standard is intended for maize flour being supplied to WFP for humanitarian purposes. Further research is needed on the effects of premix concentration per metric ton.

Technologies used for fortification in Uganda

Flour fortification requires two types of technology: a premix feeder and a mixing mechanism. Premix is added either continuously or in batches. The rate that premix is added to the flour can be determined manually, using sensors and interlocking, or with automation. Volumetric premix feeders are simple and rely on a one-time weight measurement. Gravimetric premix feeders continuously weigh the premix while adding to the flour, and loss-in-weight feeders provide even greater levels of control and automation. Volumetric feeders, loss-in-weight, and gravimetric feeders are continuous feeders, which are ideal for medium- and large-scale milling. The batch-mixing method is relatively simple to use but has a number of limitations. We outline the advantages and disadvantages of the different technologies in Table 2.

Table 2: Advantages and Disadvantages of Fortifying Technologies in Use in Uganda

| Technology | Advantages | Disadvantages | Cost Range |

|---|---|---|---|

| Volumetric feeder | Feeders consistent in dosing the premix. Suitable for large-scale operations. Not labor-intensive as compared to batch mixers. | Requires routine calibration. | US$1,500–US$3,000 |

| Gravimetric/loss-in- weight feeder | Most accurate system of dosing premix. Suitable for large-scale operations. | Very complex and expensive. Any changes to the process and/or related equipment could have a profound effect upon the operation and resulting accuracy of the loss-in-weight feeder. Requires calibration and consultation from the supplier for any modifications to be made. | US$10,000–US$15,000 |

| Batch blending/mixing system | Can be locally fabricated or retrofitted from existing machinery Easy to apply premix to the maize through using hand-held scoopers | Not convenient to achieve consistency in final fortified product. Batch mixing is slower and more labor-intensive. | Not ascertained. |

Of the 12 companies in Uganda with fortification equipment in 2016, eight were using volumetric feeders with a continuous mode of adding premixes, two companies had installed loss-in-weight feeders, and two companies had installed batch mixers, which were obtained as a donation from development partners. The two companies with batch mixers were not using them; one recently acquired a volumetric feeder to produce larger volumes of maize flour. Loss-in-weight feeders and volumetric feeders are more appropriate for large-scale fortification, but the cost of the technology can be prohibitive.

Fortificants used by Ugandan millers

Fortificants are vitamins and minerals added to foods to improve their nutritional value. These fortificants are not manufactured in Uganda, but are imported from countries such as Germany, India, and South Africa, among others.

The Uganda National Drug Authority (NDA) is responsible for approval and registration of manufacturers of fortificants and fortification premixes as compliant with the good manufacturing practices (GMPs). In addition, the NDA verifies that the fortificants and fortification premixes are imported from approved manufacturers only, and evaluates the quality (physical and chemical assessment) of fortificants and fortification premixes imported into the country. Table 3 shows the NDA-approved list of premix suppliers, last inspected in 2014. It is unknown whether these suppliers’ licenses are still valid.

Table 3: NDA-Approved List of Fortificant Suppliers

| Company Name | Country of Origin | In-country Local Supplier |

|---|---|---|

| Muhlenchemie | Germany | No |

| Prime merchantiles1 | Uganda | Yes |

| DSM | South Africa | No |

| BSFA | German | No |

| Fortitech | Denmark | No |

| Hexagon Nutrition (Export) Pvt. | India | No |

In November 2017, we collected prices of premix from different suppliers. We found that premix sourced domestically cost US$15 per kilogram, and premix sourced internationally cost US$7–US$18 per kilogram.

Maize millers reported struggling with financing and upfront purchase of premix. They also must balance the risk of stock-out with premix expiration. Industries felt that local suppliers are easier to work with than international suppliers, because they are able to avoid importation challenges and the need to obtain clearances. However, there is not necessarily a price advantage to sourcing premix domestically versus internally because the Uganda Revenue Authority waives import duties on premix.

Importers of fortificants are required to pay the taxes shown in Table 4. Taxes on imported premix have been reduced, thanks to collaboration between the MOH and the Ministry of Finance (MOF). The import duty on premix has been removed, and millers can also apply for value-added tax (VAT) exemption on imported materials.

Table 4: Taxes Levied on Premix

| Tax | Percentage Levied |

|---|---|

| Value-added tax | 18% |

| Withholding tax | 6% |

| Import duty | 0% |

Two of the five companies supplying fortified maize to humanitarian populations indicated that they were exempted from the withholding tax and import tax. However, they had to get clear documentation for the MOF explaining why they needed a waiver and the country of origin for the materials in their premix (including the harmonized system codes for each of their products). These new tax reductions on imported premix provide an ideal opportunity for costing savings on one of the significant ongoing expenditures of fortification.

Quality assurance and enforcement of the fortification legislation

During interviews and site visits with the maize millers, we observed that quality assurance and quality control (QA/QC) pose a challenge when fortifying maize flour. We found issues related to non-compliance of industries to the national standards, such as examples poor product labeling, failure to use the fortification logo, and poor hygiene practice, especially in grain handling and storage. These QA/QC issues need to be addressed before additional millers are encouraged to fortify.

Prices of maize flour on the market

As indicated in Figure 6, we found no relation between fortification and increased prices at the market. Surveyed millers indicated that they sell a kilogram of fortified maize flour at a price of UGX 2,300–2,500. However, on checking prices of individual brands on market, we found that prices ranged from UGX 1,950—3,000. Annex 4 contains a list of fortification products available on the market and a photo of their packaging.

The company offering the lowest price per kilogram of fortified maize flour does not sell products on the local market. Some companies sell fortified and unfortified maize flour at the same price. One company sold fortified maize flour at a price much higher than the rest of the companies. They attributed this to the investment the company had made in QA along the entire production chain such as building and equipping their own laboratory, ensuring they provided extension services, procuring high-quality seeds from their contracted farmers, and training the farmers on post-harvest handling of grains.

The cost of maize grains was identified to be the main cost driver across all producers of maize flour. For millers planning to fortify, the capital investment represents the greatest expense. But when considering recurring fortification costs, premix accounts for about 93 percent of the expense from fortifying. Other recurring costs for fortification include quality assurance (2 percent) and quality control (1 percent) as well as incremental production costs (4 percent). In addition to considering the cost of purchasing fortification technology, millers will need to budget for ongoing expenses such as premix.

Figure 6: Price per kg of fortified and unfortified maize flour by company name in Uganda, November 2017

Incremental cost of fortification in large-scale maize flour fortification

Engaging in fortification requires one-time costs, such as machines, dosers, and mixers, and recurrent costs, such as QA/QC, purchase of premix, and labor/production costs. Over one year, a miller fortifying their flour will incur additional costs over a miller who does not fortify, but these costs are not high. The annual incremental cost by weight shows the added costs of fortifying over not fortifying, and informs millers how to price their product. In Tables 5 and 6, we see the incremental cost by weight for large-scale millers operating at different capacities; the incremental cost of fortifying is marginally lower for large-scale millers operating on higher scale than for those operating at a slightly lower production scale. The inputs for the costing exercise are included in Annex 5.

Table 5: Incremental Costs for Fortification: Large-Scale Mill Operating at 20 MT/Day

| Annual Incremental Cost per MT of Fortified Maize Flour (Including Capital) | UGX |

|---|---|

| Cost per MT | 30,632 |

| Cost per kg | 30.6 |

Table 6: Incremental Costs for Fortification: Large-Scale Mill Operating at 60 MT/Day

| Annual Incremental Cost per Ton of Fortified Maize Flour (Including Capital) | UGX |

|---|---|

| Cost per MT | 29,553 |

| Cost per kg | 29.6 |

Recommendations on the Way Forward

Of the 33 maize millers we visited, 23 millers were not fortifying their flour, including seven who already owned fortification equipment. Further, maize millers who fortify their flour are selling their product to WFP and other humanitarian organizations, the majority of which is subsequently exported. Increasing the availability of locally-produced fortified flour will require a dual approach: to increase demand for fortified maize flour domestically, and to encourage and support millers who are not currently fortifying to do so. Stakeholders, including industry members, government representatives, development partners, and the research community, must work together to increase access to fortified maize flour in Uganda, by Ugandans, through changes in policy, programs, and practices.

Policy considerations

The Government of Uganda can assist in supporting maize millers by developing a platform for public and private sector collaboration. Ongoing dialogue will allow for sharing progress, discussing challenges in maize flour fortification, and understanding national standards and legislation on fortification.

There is a need for further clarification of national standards on food fortification, given the confusion around the national policy: some millers assumed fortification is mandatory for those who actually produce 20 MT or more per day; however, the standard applies to millers with the capacity to produce 20 MT or more per day. Additionally, millers are currently using two different standards for fortification, one according to US:EAS standards for national consumption of fortified foods, and one for export for humanitarian purposes. Although the markets for the two products are different, having two premix standards is difficult for millers in terms of enforcement and quality assurance. A lower concentration of premix per kilogram also affects the micronutrient levels of the flour. Millers must be educated on fortification standards to increase compliance with mandatory fortification standards as well as QA/QC measures.

Enforcement of national policies on food fortification needs to be improved. The majority of maize millers that are required to fortify by law are not currently fortifying, yet they face no consequence, so there is no incentive to change. Increasing monitoring and enforcement is key to motivating maize millers to adopt fortification. SPRING has assisted the government in recognizing an additional four laboratories to certify fortified products; the list of laboratories must be shared with millers and testing of samples must be expedited. The government should also research outside resources to support enforcement of fortification standards at the local level.

There is a need to increase millers’ access to the inputs for fortification, including premix and technology. To increase the availability of premix for millers, the NDA can work to certify additional suppliers of premix, which could also drive the price down for locally-produced premix. Food control agencies, such as the Uganda National Bureau of Standards (UNBS), can also build the capacity of maize millers on the installation and use of available technologies—for example, on the calibration of the machines.

Finally, we must strengthen the feedback system for fortifying industries. In the event industries fail to produce compliant fortified food samples, there should be an effective information system to enable industries to take action before these samples are taken to the market. Currently, collected data do not affect day-to-day fortification activities; this is a significant missed opportunity.

Programmatic considerations

Private sector

Currently in local supermarkets, fortified maize flour is sold at the same or lower price than unfortified maize flour, partly due to lack of consumer awareness of the benefits of fortified flour. The private sector should incorporate fortification into their routine marketing and communication campaigns to increase public awareness on the availability, benefits, and identification of fortified foods. The fortification logo should represent an added value to the consumer, describing not only the addition of vitamins and minerals, but the knowledge that the product has passed a QA/QC check and is of higher quality than its unfortified counterpart.

Mobilizing and clustering maize millers into associations can increase their access to resources, trainings, and advocacy efforts. As a unified group, maize millers can more competitively propose amendments to national legislation on food fortification and lobby for tax incentives. They are also better positioned to write proposals and request funding from private foundations. A group of maize millers is also better positioned to buy premix and fortification inputs at competitive rates compared to a single miller.

Development partners

The National Working Group on Food Fortification (NWGFF) and the government have previously led awareness efforts on creating demand for fortified foods. But development partners and organizations can reinvigorate mass media campaigns to raise awareness of fortified foods. In 2016, public sensitization campaigns informed the public about products with the big blue “F,” but maize flour fortification was not included in the campaign. The next communications campaign can feature fortified maize flour in addition to fortified oil and wheat flour, and inform consumers through television advertisements, radio spots, and point-of-purchase marketing about what fortified food means and why added vitamins and minerals are beneficial. This initiative goes hand in hand with encouraging the private sector to market their fortified products as being of higher quality, thus mutually reinforcing this key message.

Outside partners can also support dialogue between the public and private sectors through the creation of a communications platform for maize millers. Through a website or another mass communication platform, maize millers could access information about fortification, learn about the standards, contact suppliers, and learn about funding opportunities.

We found that 28 maize millers have sufficient production capacity to fall under mandatory fortification standards in Uganda, however, only five of these millers fortified their flour as of November 2017. Development partners should work with this “low-hanging fruit,” and rectify the situation by helping them understand standards and regulations, secure premix, learn where there are laboratories, and certify samples of fortified foods. This same approach was successfully adopted for wheat flour fortification.

Research community

Universities and research institutions can also be engaged to develop innovations in fortification technology and adapt existing technology to the local context. The SANKU fortification equipment, currently used in Tanzania, was developed by a university team, and has served as an interesting model for Uganda to consider adapting. The research community has the potential to innovate cheaper, local technologies that can serve Ugandan maize millers.

Next steps

The next step is to further engage ministries, millers, and outside institutions to promote fortification of maize flour. The public sector should encourage procurement of fortified maize flour for vulnerable/captive populations, including schoolchildren, hospital patients, armed services, and prison populations. The MTIC has led the way by offering to support fortification efforts. Ongoing dialogue between millers and government will facilitate fortification efforts and help resolve barriers on the road to maize flour fortification.

Footnotes

1 Prime Merchantiles International, Ltd., is the local supplier of Muhlenchemie.

References

Enzama, Wilson, Ronald Afidra, Quentin Johnson, and Anna Verster. 2017. Africa Maize Fortification Strategy 2017-2026. Atlanta, GA: Food Fortification Initiative/Smarter Futures Project.

GAIN (Global Alliance for Improved Nutrition). 2015. The Fortification Assessment Coverage Tool (FACT) to assess the coverage and consumption of fortified vegetable oil, wheat flour, maize flour and salt. Kampala: Uganda Ministry of Health.

MOH (Ministry of Health). 2017. National Industrial Food Fortification Strategy-Uganda. Kampala: Uganda Ministry of Health.

MOH (Ministry of Health). 2011. The Food and Drugs (Food Fortification) (Amendment) Regulation, 2011 (Under section 41 of the Food and Drug Act, Cap.278). Kampala: Uganda Ministry of Health.

SPRING. 2017. Uganda: Mapping of Maize Millers. A Road Map to Scaling Up Maize Flour Fortification. Arlington, VA: Strengthening Partnerships, Results, and Innovations in Nutrition Globally (SPRING).